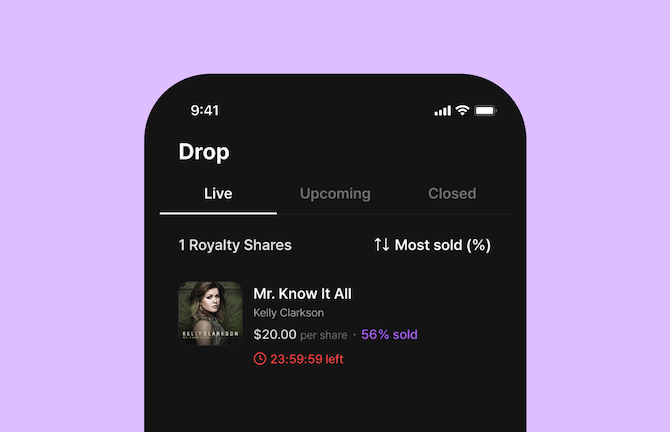

Musicow US Vol. 1 LLC (“Musicow”) operates a website at musicow.io and certain mobile apps (the “Platform”). By using the Platform, you agree to our Terms of Service and Privacy Policy. Neither Musicow nor any of its affiliates provide investment, legal, or tax advice, and nothing on the Platform should be construed as such. Any examples or outcomes described on the Platform are for illustrative purposes only and do not represent guaranteed or typical investment results. Prospective investors should consult their personal advisors regarding individual circumstances. See additional important information here: Full Disclosure.

Musicow is currently raising and may in the future raise capital pursuant to Regulation A under the Securities Act of 1933. This may include use of the services of the Musicow Platform, licensed from North Capital Investment Technology, Inc. Such offerings are conducted through Rialto Markets LLC, a registered broker-dealer, member FINRA / SIPC, which acts as the broker-dealer of record for the offering.

Any indication of interest in response to Musicow materials may be withdrawn or revoked without obligation or commitment of any kind, prior to qualification of any applicable Regulation A offering. No offer or sale of securities will be made without a qualified offering circular. No money or consideration is being solicited and, if sent, will not be accepted. Indications of interest involve no obligation or commitment. For more details, see our Offering Circular.

Participation on the Platform does not constitute an indication of interest in any securities offering and does not imply any obligation or commitment of any kind.

For more information about brokerage services provided by Rialto Markets LLC please see our Form CRS report (Customer Relationship Summary).